From GENIUS Act to Crypto-backed Mortgages: Are We Headed for Crypto Paradise or Financial Purgatory?

While GENIUS act could actually be a genius idea through macro lenses, there is a fine line between genius and madness when it comes to crypto-related regulation.

Today’s piece is not about any trade per se, but rather an amateurish reflection on recent developments surrounding stablecoins and their potential connection to macro.

GENIUS Act Might Be Quite Genius … for Funding Debt

The GENIUS Act officially stands for the Guiding and Establishing National Innovation for U.S. Stablecoins Act (cringey acronyms are Congress’s idea of fun. see more here: The Hill). The most important clause in the Act demands that stablecoin issuers should:

“Maintain 1:1 backing of stablecoins in high-quality liquid assets,” including:

U.S. currency or deposits

Short-term U.S. Treasury instruments (≤93 days)

Repo and reverse repo backed by Treasuries

Certain money market funds and central bank reserves

This means that for each $1 USDC (a type of stablecoin) issued, there must be at least $1 of approved assets sitting in the issuer’s reserves to safely and quickly cover redemption, maintaining the peg to fiat currency.

For readers from traditional finance backgrounds, here’s a worked example illustrating how stablecoins are created and transacted:

An institution (e.g., Binance) wants to “mint” $1 million of new USDC to distribute to customers. It pays Circle (USDC’s issuer) $1 million in fiat and receives $1 million of USDC in its wallet on-chain.

By construction, 1 USDC = 1 USD.

Circle is then obliged to hold the $1 million in approved liquid assets.

Secondary market transactions (using USDC to buy ETH, or BTC to buy USDC) do not affect the total USDC outstanding, so Circle’s reserve requirements remain unchanged.

USDC is destroyed upon redemption when institutions swap USDC back for fiat. Circle reverses Step 1, paying out cash (or selling Treasuries if needed) and burning the redeemed USDC.

For the stablecoin industry, the Act enhances confidence and reduces the likelihood of de-pegging attacks. For the wider economy, the Act subtly creates structural demand for T-bills, indirectly supporting the Treasury’s funding needs. As stablecoins expand, they create legally mandated demand for short-term Treasuries whenever there is demand for stablecoins.

The Treasury currently prefers issuing at the shorter end to avoid locking in high long-term yields (See Bloomberg). The chart below shows current US Treasuries outstanding by maturity date.

In the ultra short-term (<93 days), there is currently $4.8 trillion of T-bills outstanding, while USDT and USDC together have a market cap of ~$220 billion (5% of short-term Treasuries outstanding). As stablecoins roll forward their reserves, even without further expansion, 5% of short-term T-bill demand is now structurally mandated by law.

On redemptions, issuers are not required to sell Treasuries if they have enough cash, and given today’s yields, may prefer retaining Treasury holdings. However, the risk during sharp liquidity crunches remains unclear. So far, USDC and USDT have experienced stable market caps, including through COVID, but have seen >20% or even >30% net redemptions over one-month periods. While these were small nominally back then, a 20% redemption at larger scales could force issuers to sell large amounts of T-bills in a short period of time, testing market liquidity and functioning.

Should an acute financial crisis prompt households and businesses to strictly prefer cash, stablecoin issuers could face intraday redemption pressures, forcing Treasury sales and adding pressure to short-term rates. As stablecoin market capitalization grows, this systemic risk will only become more important to monitor.

Crypto Meets Housing: Synthetic Leverage, Moral Hazard, Systemic Risk

A recent proposal under the FHFA seeks to allow crypto holdings to count as mortgage reserves, aiming to extend homeownership opportunities to crypto-rich, cash-poor buyers. CNBC: Trump-backed crypto mortgage policy

Call me a dinosaur, but unless these “crypto holdings” are exclusively stablecoins, this proposal is a reckless experiment with systemic risk of monumental proportions for financial markets and the broader economy.

1️⃣ I question our abilities to properly risk-adjust crypto holdings.

In normal mortgage assessments, marked-to-market portfolios (equities and bonds) are accepted with some haircut (say 70% of current value). This may be reasonable as there are deep, stable, institutional participation in the market, and people’s portfolios usually contain negatively correlated assets (cyclical vs non-cyclicals, equities vs bonds), so that volatility behaviors can be reasonably assumed, even in extreme cases.

Crypto holdings, by contrast, are likely to be 100% correlated in severe financial stress, as investors dump risk assets first. We have never experienced a global downturn with crypto at systemic scale, making credible risk-adjustment effectively impossible.

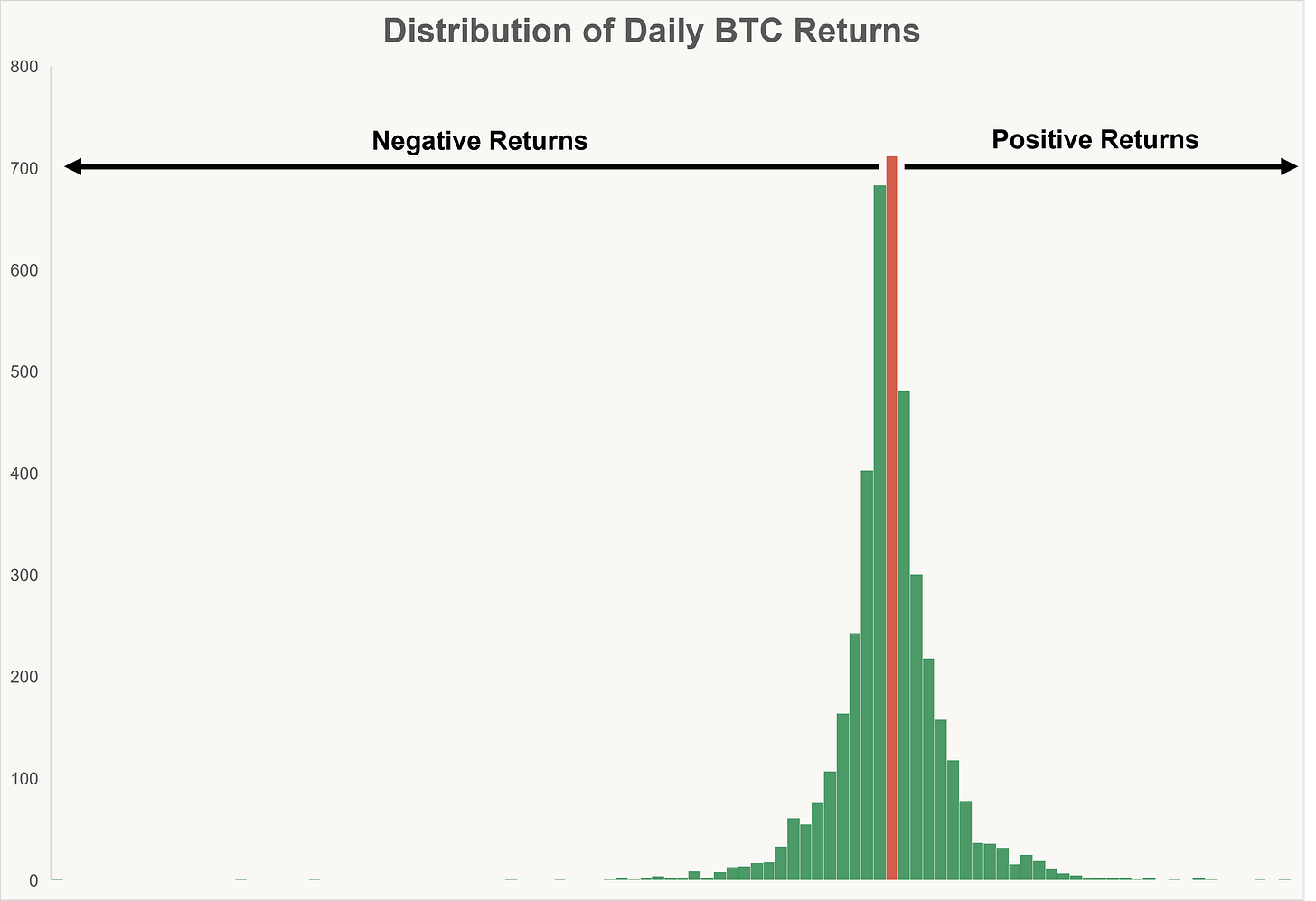

Below is a chart of Bitcoin’s daily returns, illustrating its extreme volatility and pronounced negative skew. The potential for frequent and large downside moves (daily drop can be as large as 50%, even for established cryptos like BTC) underlines why crypto is unsuitable as a stable reserve in mortgage underwriting, particularly at systemic scale.

Worse, crypto can crash independently of macro conditions, instantly wiping out borrowers’ “reserves.” At scale, crypto-backed mortgages could trigger or amplify systemic risk during crypto crashes.

Moral hazard: Borrowers can present inflated crypto “reserves” to qualify for mortgages, knowing lenders (and ultimately taxpayers) will bear the downside risk if crypto collapses while retaining the upside if it recovers.

2️⃣ This proposal enables synthetic leverage across two volatile markets.

Using crypto to qualify for mortgages while retaining crypto exposure allows borrowers to layer housing debt on top of crypto holdings, creating synthetic leverage without liquidation friction. Borrowers effectively become leveraged players in both crypto and housing markets simultaneously, without selling crypto or realizing gains, while transferring risk to the financial system.

3️⃣ It encourages speculative property trading by crypto holders.

Crypto-rich individuals will buy homes they otherwise could not afford, adding speculative demand and pushing housing further out of reach for end-users.

Rational crypto holders could use crypto as reserves to buy a leveraged house, then sell the house for fiat once prices rise, extracting fiat gains while retaining crypto exposure. This effectively creates a yield-bearing crypto portfolio, with yield equal to (housing price appreciation - mortgage rate).

Moral hazard compounds here: borrowers capture upside if housing prices rise while lenders and taxpayers bear the downside if housing prices fall.

If history is any guide, this will link housing bubbles to crypto bubbles, increasing the likelihood of simultaneous bursting.

In short, “smart” crypto regulation like the GENIUS Act can help stabilize markets, but it can also plant hidden risks that only reveal themselves in a crisis. Allowing crypto-backed mortgages risks unleashing volatility and hidden leverage into housing finance. We need to tread carefully — before opening the gates of hell to the next housing crisis.