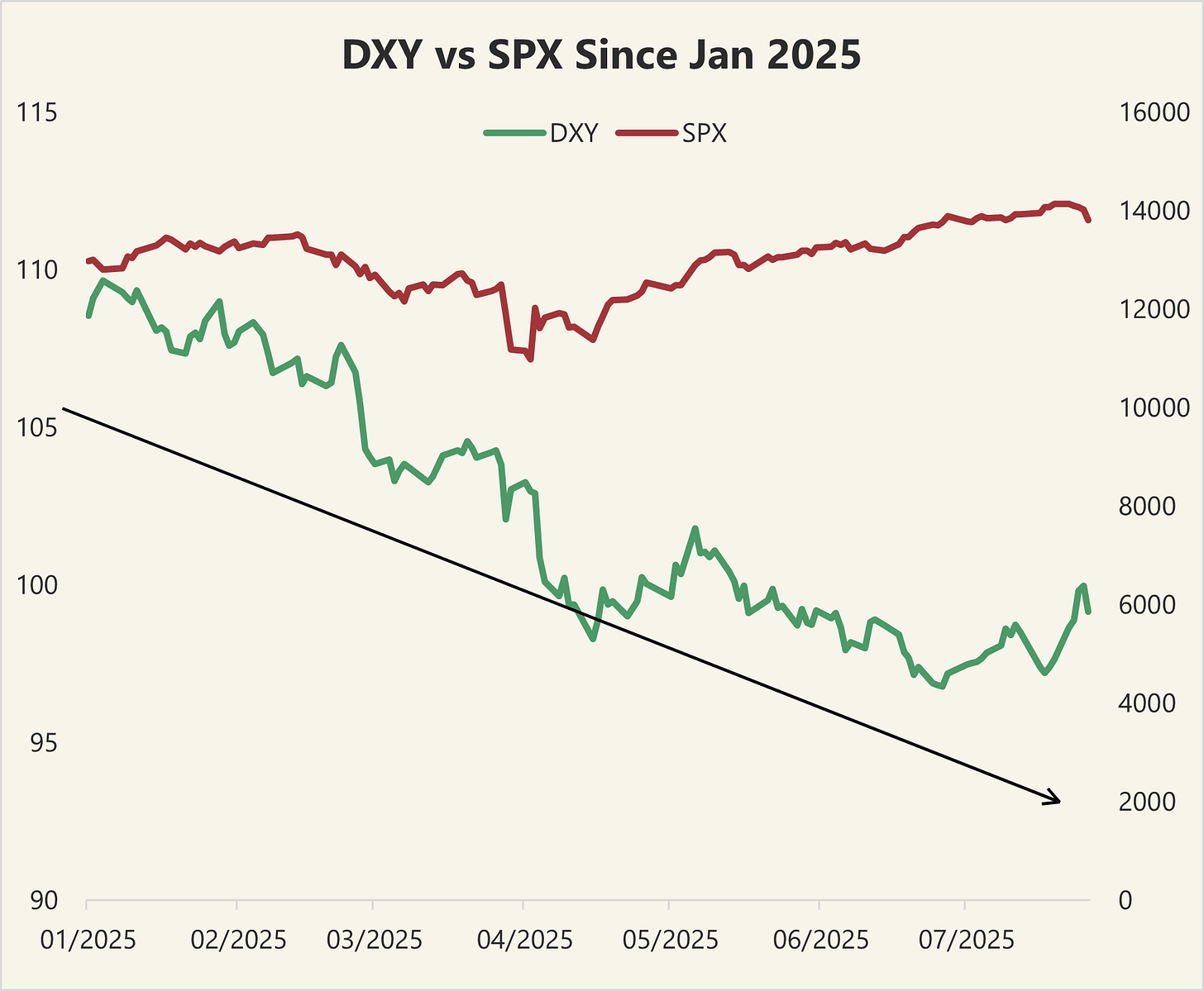

I learned two things about macro this year: King Dollar can weaken, and the S&P just won’t quit. While retail investors are cheering U.S. equities' resilience — even through Liberation Day surprises and half-hearted tariff “deals” — anyone investing from outside the U.S. should take a closer look at their portfolio.

Why? Because FX is quietly eating your alpha. (Or more precisely, "“negative alpha” from FX is eating your beta lol)

(Chart 1: A weakening dollar, strong-ish SPX — but don’t celebrate just yet)

Same Index, Different Return: The Currency Drag

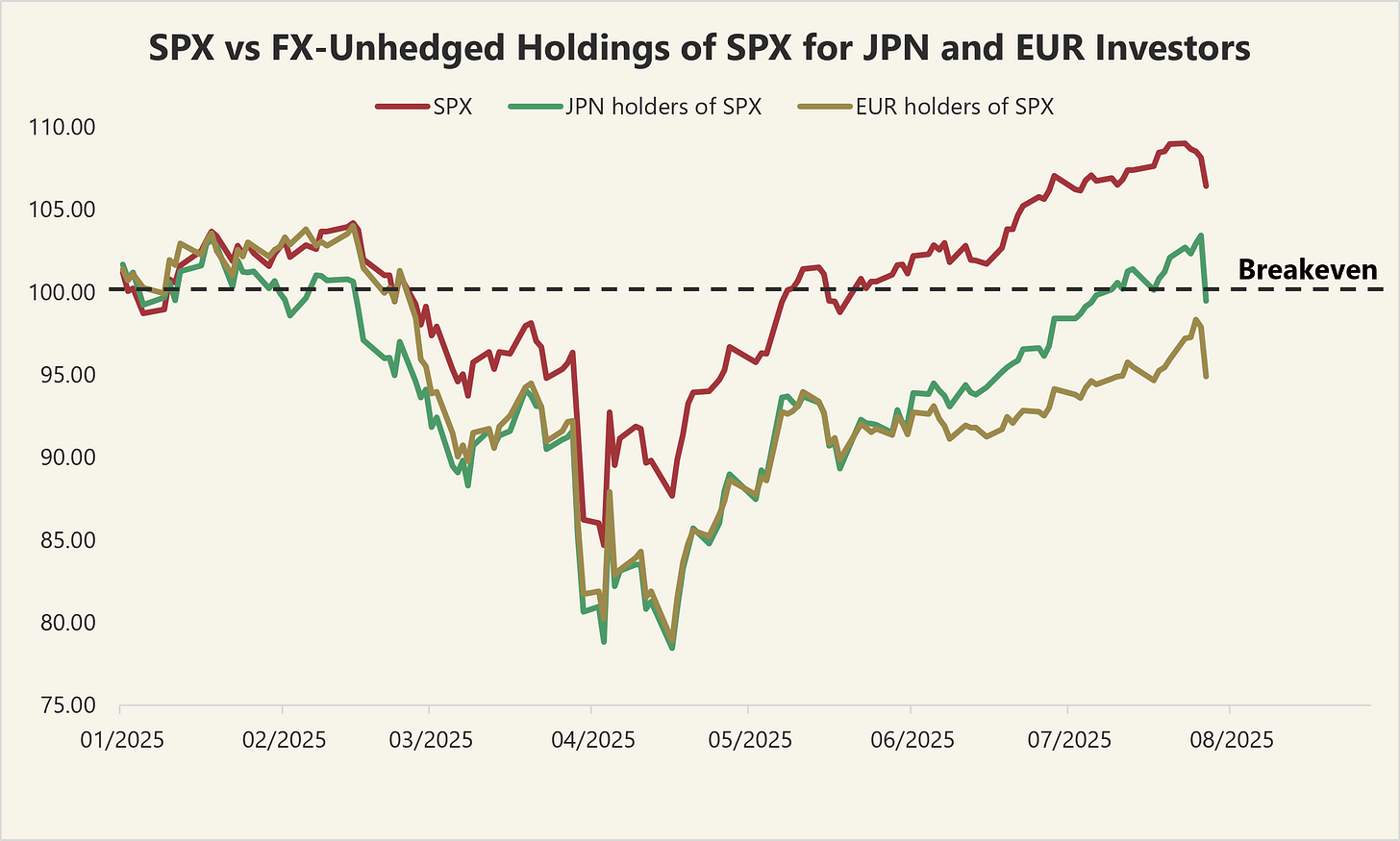

Let’s start with the chart below (all returns indexed to Jan 1st 2025): while S&P500 broke above all time high and ended up +6.4% on the year at the time of writing, the results look very different for foreign investors whose currencies rose against the dollar.

(Chart 2. S&P500 returns by base currency)

Japanese holders of the same index ended up roughly flat on the year after last week’s jobs report, whereas European investors on net achieved -5.1% by holding S&P unhedged — that’s an 11.5 percentage point gap between hedged and unhedged exposure coming simply from currency moves alone.

FX Hedging Isn't Just a Footnote

In a world where the dollar is softening and volatility is still (relatively) contained, FX exposure becomes a major P&L driver — and in some cases, the only thing separating green from red.

In my previous post (linked), I laid out how capital recycles back into USD assets and why they structurally support USD as a result. With the US economy seeing some signs of weakening, pricing of rate differentials and active flows will likely play a more decisive role in driving FX and asset performance.

Which brings us to Japan.

The Case for the Yen (and Japanese assets)

At risk of sounding like a broken record to my friends, I see Japan as one of the most asymmetric macro opportunities today — both from a valuation and cyclical perspective. The setup checks all three boxes: undervaluation, policy shift, and a favorable risk-return profile.

1. Policy normalization is back on track

Inflation remains sticky but controlled.

With the trade deal and the domestic election behind us, the BoJ now has a clearer runway for gradual normalization.

No abrupt pivot needed — just a benign tapering path that reintroduces rate differentials without financial stress.

2. The yen is still cheap AF

On a real effective exchange rate (REER) basis, JPY remains one of the most undervalued major currencies, near multi-decade lows. (I will spare readers and myself of the chart - not really interesting too look at a straight line down.

Even a partial reversion would support total returns for JPY-based investors — and it’s not being priced aggressively.

3. Risk asymmetry is building in dollar assets

U.S. inflation remains above target, with the impacts of tariffs being largely elusive so far.

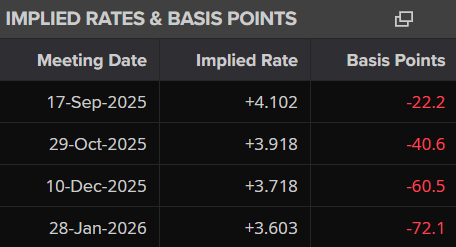

Even if growth cracks, the Fed is unlikely to rush to cut — not unless the slowdown feels recessionary. (Yes, I am saying going against market pricing, which now has the Fed cutting nearly twice by year end)

That means the equity risk premium (ERP) could compress further, reducing the compensation for holding U.S. assets and trigger more active flows to seek better risk-reward elsewhere (e.g. Japan, where ERP is healthy).

Market Hasn’t Fully Priced Yen Upside

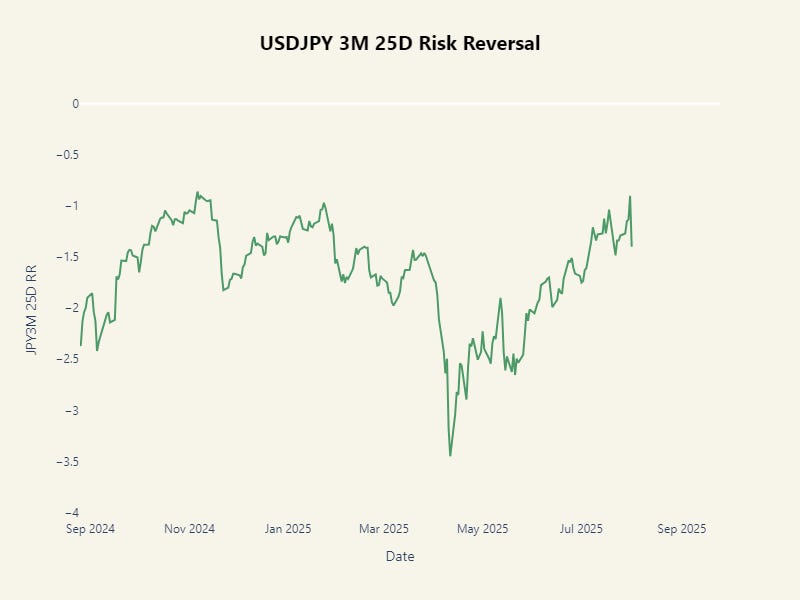

Despite the macro backdrop, USDJPY 3M risk reversals are only modestly skewed toward JPY strength relative to history. That could suggest:

JPY is still underowned — not many people hedging yen upside. But this could also be intentional as I would lay out later

Upside surprises in yen could spark positioning squeezes

FX options aren’t pricing in meaningful left-tail risk in USDJPY — a potential opportunity for cheap optionality

Regardless, the “consensus” directionality is clear, and you would likely have downside protection from MoF intervention.

Given this FX view, I like allocating to Japanese assets in an unhedged manner*. Even if Japanese equities underperform, currency appreciation can offset or cushion losses. Further, in a true global shock like a U.S. recession is surely to create, JPY tends to rally as a safe-haven, providing tail-risk protection. In short, I think this is one of those rare setups where not hedging is a source of alpha.

*Note: There is more to be said and analyzed for going long JPN assets, but I want to stay on the FX angle for this post.

Final Thought

Most investors focus on the shiny stuff — equities, earnings, headlines. But in macro, it’s often the dull-but-deadly mechanics that quietly shape returns. FX hedging is one of them.

As 2025 unfolds, ignoring FX is ignoring risk. And in a world where the dollar is no longer king, and EUR has rallied so much already, it might just be time to become a bit of a Yen-thusiast.